Leveraging private investment in power transmission infrastructure in West Africa

Africa Connected: Issue 3

Introduction

Earlier this year, the Economic Community of West African States (ECOWAS) presented its updated Master Plan for Regional Power Generation and Transmission Infrastructure 2019-2033 (the Master Plan). The Master Plan is part of ECOWAS's drive to develop the West Africa Power Pool (WAPP) – a cooperative power pooling mechanism for integrating national power system operations into a unified electricity market in the West African region.

Like in the rest of sub-Saharan Africa, a vast proportion of the population in West Africa is without access to electricity, despite the region's ample natural resources. The lack of reliable and affordable electricity has hindered economic development and job creation. Given the small size of the power markets in most of the ECOWAS countries, increasing regional integration can lower the average cost of supply through economies of scale. It can also promote diversification of electricity sources, including renewables, enhancing system reliability and grid stability.

This will, however, require significant investment in a stable and interconnected transmission network with minimal transmission losses that can support load increase, more flexible cross-border trade flows and the intermittent output of renewable power sources. The Master Plan has identified 28 priority transmission line projects with a total length of approximately 22,932 km at an estimated cost of USD10.48 billion. The majority of them are cross-border interconnectors although some are national projects with regional significance. In this article I will focus on interconnection infrastructure.

Government ownership (including through public utilities) has been the dominant approach to financing interconnection projects in Africa. Poor financial health of national utility companies in general and fiscal constraints of most governments in the region limit their ability to invest, even in financially viable projects. Private involvement in these projects could help ease the financing constraints and bring experience in project implementation and operation as well as better organizational and financial discipline.

This article will look at the possible models for private investment in transmission infrastructure in the region, identify some potential challenges and consider how they may be addressed.

Investment models

In the context of cross-border interconnections, private investment may take the form of merchant investment or independent power transmission (IPT). Neither model has been adopted in Africa to date.

Merchant investment

Most interconnection projects in the world have used the merchant investment model. Under this model, the merchant investors build and operate a transmission line. The owner of the line sets the terms and conditions for its access and generates revenue based on the amount of energy flowing along the line and the price differences between the two ends of the line. Access to merchant lines is usually proprietary rather than open to all transmission users.

Many power utility companies in sub-Saharan Africa are vertically integrated, state-owned monopolies. In many cases, their tariffs are set at artificially low levels due to the income level of their customers and political considerations. The resulting lack of flexibility and dynamics in the relevant wholesale electricity markets could undermine the basis of the business case and revenue model for merchant investment, which is closely linked to the projected price differentials between two markets. Furthermore, viability of a merchant line often depends on its ability to maintain a monopolistic position to serve as a link between two markets based on proprietary access. This model does not seem consistent with the stated aim for the West Africa Power Pool, which is to develop an integrated unified electricity market.

Independent power transmission (IPT)

Another model is to finance, build and maintain the transmission line by way of independent power transmission (IPT). The IPT model has been identified by the World Bank as the "business model best suited to the conditions in Africa."1 In essence, it involves the government (or the state-owned utility) tendering a long-term contract whereby the IPT (the winning bidder) will be responsible for building and operating a transmission line in exchange for contractually defined payments dependent upon the availability of the line.

IPT projects have been adopted in many countries, though mostly in the context of in-country transmission. Adopting the model for interconnection between countries is, however, likely to be more complex, not least due to the need to coordinate between the governments of the relevant countries.

In West Africa, the Côte d'Ivoire-Liberia-Sierra Leone-Guinea (CLSG) interconnection project may point to a way forward. This USD508.2 million project involves the construction of a high voltage (225 kV) transmission line of over 1,300 km and associated substations connecting the four participating countries' energy systems into the WAPP. The project is implemented through a regional transmission company (TRANSCO CLSG) which is responsible for the financing, construction, ownership and operation of the project. TRANSCO CLSG is a special purpose vehicle (SPV) owned equally by the national utilities of the CLSG countries.

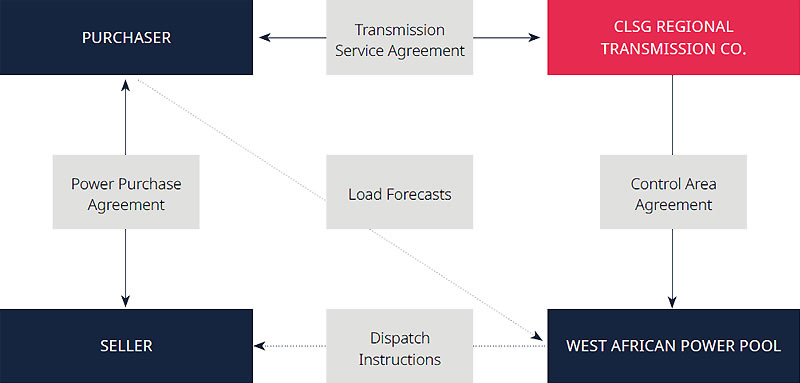

Diagram: Illustrative contractual structure for the CLSG transmission line.2

To encourage its usage, the CLSG transmission line will have an open access policy. Power purchase agreements have been signed between Côte d'Ivoire's national utility and those of the other three countries. Each of them has entered into a transmission service agreement with TRANSCO CLSG. The transmission tariff is set using the postage-stamp methodology3 so that transmission costs are effectively charged to the power purchasers based on their relative shares of the trade through the transmission line. To mitigate against the risk of funding shortfall due to low trading volumes, the shareholders of TRANSCO CLSG undertake to pay for any shortfall from trading revenue. This pricing methodology both ensures cost recovery and facilitates trade through the transmission line. The CLSG project is currently under construction and is expected to be commissioned in late 2019 or early 2020.

While the CLSG project structure does not involve any private ownership of the project company, it is conceivable that a similar structure may be adopted to implement the IPT model; for example, by replacing government-owned shareholders of the transmission SPV with private sector project sponsors.

This was in part the structure adopted by the Central American Electricity Interconnection System (SIEPAC) which had been taken into account in the design of the CLSG project.4 In SIEPAC, the transmission company, EPR, owns the 1,793 km interconnector (230 kV) which links the power grids of six Central American countries. EPR is owned by eight national utilities or transmission companies together with a private company (ENDESA of Spain) which is responsible for managing EPR. During the project design stage, the option of relying entirely on private sector investment was considered. However, it was decided that there may not be sufficient interest from the private sector for such structure due to the perceived project risks and natural monopoly nature of transmission.5

However, there seems no reason why, through proper risk management and with adequate financial incentives, such a structure cannot be adopted with entirely private ownership.

Challenges

The challenges faced by the power sector in sub-Saharan Africa are well documented. There are two challenges in particular to highlight in the context of introducing private investment in interconnection projects, especially IPTs: the regulatory framework and financial viability.

Regulatory framework

As reported in the Master Plan, in most of the countries in West Africa, the electricity sector remains vertically integrated with monopoly networks. Although full-unbundling is not a necessary pre-condition for IPT, existing legislation and regulation will need to be reviewed to enable the IPT to operate alongside the national utility. The grid code will need to be established or revised to provide operating procedures and principles. In the context of an interconnection project, this will need to be done for each country it connects and could be cumbersome and result in a long development lead time.

This issue is highlighted in the ongoing North Core Interconnector Project (a 330 kV transmission line connecting Nigeria, Niger, Benin and Burkina Faso). According to the Master Plan, the SPV structure adopted in the CLSG project had originally been envisaged for the North Core project but was not adopted in the end in view of the considerable delay that necessary adjustments to the national legal frameworks would cause.6

Financial viability

The CLSG project above has provided an example of how transmission tariffs may be set to meet any minimum revenue requirement. Investors will, however, need confidence that the contractual payments will be received from the transmission line users, which are likely to be national utilities. The general poor financial health of the national utilities in the region is likely to be a concern in this regard. It is instructive in this context to note that many countries in the region have experience in addressing this same issue in independent power projects (IPP), which may provide valuable lessons for developing IPT projects. For example, possible credit support may be provided through the use of escrow accounts to prioritize payments to private sector market participants. Where this is insufficient, governments may provide sovereign guarantees (or other government support) for payment obligations to IPTs. Additional security may also be provided by development finance institutions (DFIs).

Last but not least – political commitment

On a more general note, getting any large-scale infrastructure project off the ground will require political support, government commitment and strong public governance. For transmission projects, these factors are key in enabling inter-country negotiations, prioritization of regional projects, effective deployment of state resources and coordination of stakeholders such as regulators and utilities. This will require national governments to take a long-term view of the benefit that these projects will bring through regional energy trade, in terms of energy security, economic efficiency and ultimately the welfare and quality of life of their electorates.

By Joseph Lam

This article forms part of Africa Connected: Energy in Africa – innovation, investment and risk:

2Diagram acknowledgment: World Bank. 2012. Africa - West Africa Power Pool Fourth Adaptable Program Loan (WAPP APL4) for First Phase of the Cote d'Ivoire, Sierra Leone, Liberia, and Guinea Power System Re-development Project (English). Washington, DC: World Bank.

3This means that transmission tariff is charged at a fixed charge per unit of power transmitted within a particular zone irrespective of the distance travelled.

4World Bank, Africa - West Africa Power Pool Fourth Adaptable Program Loan (WAPP APL4) for First Phase of the Cote d'Ivoire, Sierra Leone, Liberia, and Guinea Power System Re-development Project (English)

5World Bank. 2010. Regional power sector integration: lessons from global case studies and a literature review (Vol. 10) : Central American Electric Interconnection System (SIEPAC) : transmission and trading case study (English). Energy Sector Management Assistance Program (ESMAP) ; Brief note 004/10. Washington DC ; World Bank.

6Under the agreed structure, project assets will be turned over to the respective national utilities upon project completion. See Djibril Amadaou MAILELE. 2019. Western Africa - AFRICA- P162933- North Core Dorsale Nord Regional Power Interconnector Project - Procurement Plan (English). Washington, D.C.: World Bank Group